Impact Investing

Using Social Impact Skills in My Internship With Reinvestment Fund

This post was written by Seth Brown, a third year dual Masters of Public Policy and Masters of Business Administration (MPP/MBA) candidate at Duke’s Sanford School of Public Policy and the Fuqua School of Business, in November 2016. Prior to graduate school, Seth served 5 years as an Army officer. At Duke he has led […]

The Effect of Inserting the Impact Variable: SOCAP16

This post was written by Zen Dedekind, CASE i3 Fellow and Co-Chair, in October 2016. Zen attended SOCAP, the annual conference in San Francisco that brings together impact investors, social entrepreneurs, foundations, corporations, global nonprofits, and others contributing to a vibrant marketplace for socially, environmentally and economically sustainable solutions. For more information about SOCAP, visit their website. Impact […]

What the Unilever Seventh Generation Acquisition Means for Social Ventures

This post was written by CASE Executive-in-Residence and Sproxil Co-Founder Alden Zecha in October 2016. He has over 25 years of experience in more than 35 countries and has founded several companies, including SEAD Innovator Sproxil, Inc., a social venture that provides a consumer SMS and app product verification service to help consumers avoid purchasing counterfeit […]

A First-Timer’s Experience: 3 Reflections from SOCAP16

This post was written by Robyn Fehrman, Managing Director of CASE, in September 2016. Earlier this month, I had the opportunity to attend SOCAP16 for the first time. With the tagline “A Conference at the Intersection of Money + Meaning,” this annual convening of global innovators, investors, foundations, governments, institutions, and social entrepreneurs deeply intrigued […]

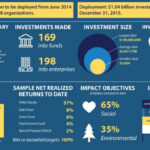

29 Orgs Committed $1.5B to Impact Investing. Where’s the Money after 18 Months?

September 2016, Cathy Clark, Faculty Director of CASE I got the call from the White House, in May 2014. “We’re going to have some major new commitments of impact investment capital at the meeting in June. Would you be interested in helping us track how the money is spent?” What do you say to a […]

Day in Durham: Spending Time in the Muck

This post was written by Tiffany Hsieh, a 2018 Fuqua MBA in August 2016. For the past three years, she conducted impact evaluations of education programs at the non-profit, independent research institute SRI International. She previously taught middle school special education in Colorado as a Teach for America corps member. Tiffany received her undergraduate degree […]

A Summer Interning in Social Impact Bonds and Healthcare

This post was written by Julia Korn, Daytime MBA 2017, in August 2016. Julia came to Fuqua from a career in healthcare. Most recently, she worked for North Shore-LIJ Health System (now Northwell Health). At Fuqua she is a CASE Fellow and the co-lead of the Net Impact Careers Cabinet. She graduated magna cum laude […]

From Lemonade to Babies: 8 Lessons on How to Talk About Impact Investing

This post originally appeared on B the Change Media in August 2016. Cathy Clark, Faculty Director of CASE The other day my 8-year-old daughter sat at the barstool in front of our kitchen island and asked me to explain to her what impact investing is. She knew my book was on this topic, that I […]

CASE Chat with Bonny Moellenbrock, Executive Director, Investors’ Circle

July 2016 This month’s CASE Chat features Bonny Moellenbrock, Executive Director of Investors’ Circle. Durham-based Investors’ Circle is the largest and most active early-stage impact investing network in the world. To date the network has connected over 300 social enterprises with nearly $200 million in capital. In the CASE Chat, Bonny discusses the need for […]

Navigating Impact Investing: The Opportunity in Impact Classes

July 2016 The growth in interest in impact investing has been steady over recent years, with a newly released study by U.S Trust showing that 93% of millennials interviewed saying social impact is key to their investing decisions. Despite this, multiple barriers still exist that inhibit many investment managers from entering the field. These barriers can […]